Grier’s “business” partner Shiwen Yap sued in $14 million stock scam! The below article explains that amazing caper in great detail.

The Singapore judge said he is “unable to accept” Yap’s “self-serving declaration” that he had “no knowledge about the fraudulent transactions.” “At the very least, a credible explanation supported by evidence is required” to support his claim, “but Yap had not produced any,” the judge added.

https://www.techinasia.com/major-korean-bank-bought-14m-wework-shares-fake

A major Korean bank bought $14m in WeWork shares. They were fake!

In early 2019, co-working space giant WeWork was months away from a highly anticipated IPO. Shinhan Securities, the brokerage and investment arm of a South Korean Big Five bank, wanted a piece of the action.

The bank found a seller that owned WeWork shares: Aurora Grand Limited, a company incorporated in the British Virgin Islands.

In June 2019, Shinhan transferred US$14.2 million to Aurora in exchange for those shares.

Of course, the IPO did not happen. But there was bigger snag: It turned out that Aurora did not actually own any WeWork shares, which would have lost 94% of their peak value after the flexible workspace provider imploded.

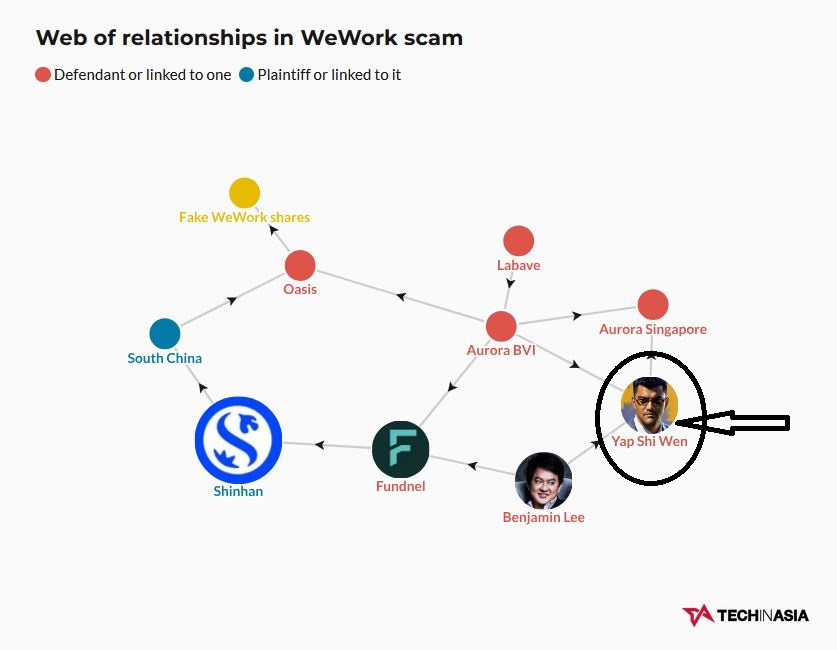

What followed was a legal battle in Singapore instigated by Shinhan against Aurora and several others in 2022 to claw back its money.

The civil lawsuit, which cited fraud and exposed the tangled web of global finance, uncovered the sudden disappearance of an Aurora employee. Shinhan also alleged that entities and people linked to Aurora were bogus.

On the flipside, the investment bank’s due diligence before buying the WeWork shares was questioned.

Tech in Asia contacted the key parties in the suit, but they declined to comment. These include Shinhan as well as defendant Benjamin Lee, who founded Singapore-based tech startups Sapio and Sugar. He is now managing partner at Ixora, a Los Angeles-based VC fund.

Other defendants in the lawsuit that withheld remarks include Alta Group (formerly Fundnel), the Singapore-based fintech company that facilitated the transaction, and Yap Shi Wen, a former tech journalist who was Aurora’s nominee director in the city-state.

Shinhan reached a settlement with Alta Group in June 2023 as well as with Yap and other parties in October 2022.

But the bank’s case against Lee, who was added as a defendant in late 2023, is ongoing. In its statement, Shinhan accused Lee, along with one or more of the other defendants, of devising “a fraudulent scheme” to swindle the bank.

Lee denied the claims, stating that Shinhan had a “drastic change in position” despite “a complete lack of reasons.”

Fraud found

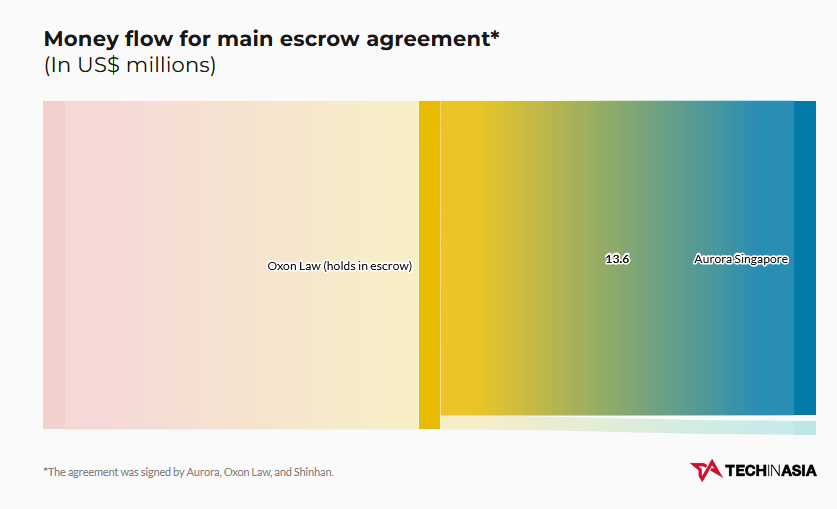

The transaction between Shinhan and Aurora seemed simple.

Aurora’s subsidiary, Oasis Buono Limited, supposedly held WeWork shares. Shinhan’s affiliate, South China, would buy Oasis and in effect own the equity.

It was agreed that South China would pay US$14.2 million to Oxon Law, a law firm in Singapore that would hold the money in escrow.

Oxon Law would then transfer US$13.6 million – the amount after deducting fees – to Aurora after “closing deliverables,” which include documenting Oasis’ new ownership, were handed over.

Money flow for main escrow agreement*

(In US$ millions)

This was where the irregularities began.

First off, South China transferred the money to Oxon Law around June 2019. But contrary to the agreement, Oasis did not update the documentation right away. The amendments were only made in 2020, after South China sought a court order to force Oasis to do so.

But the bigger shock would emerge later that year, when South China reached out to WeWork to seek proof of Oasis’s shareholding. The co-working giant revealed that Oasis did not actually own a piece of WeWork.

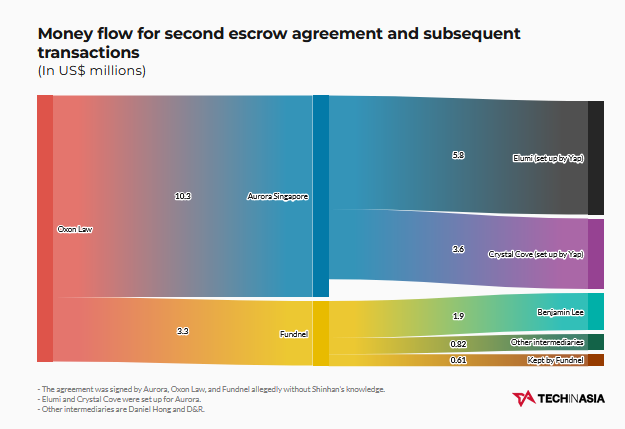

Shinhan also alleged irregularities in the money transfer. At the time, the bank did not know about a second escrow agreement between Aurora, Oxon Law, and Fundnel, which assisted in the transaction.

Under this agreement, Aurora Grand had instructed Oxon to send just US$10.3 million instead of US$13.6 million to Aurora Singapore, the bank claimed in its suit.

The remaining US$3.3 million was transferred to multiple parties including Lee and Fundnel as well as the two Singapore companies incorporated by Yap, Aurora’s nominee director, on its behalf.

Offshore and opaque, or a sham?

Offshore tax havens like the Cayman Islands or the British Virgin Islands, where Aurora was incorporated, offer more just low or nonexistent taxes. The main appeal is the secrecy accorded to companies incorporated there.

Opacity was the hallmark of Aurora. Even before the deal was sealed, Shinhan had asked the firm to share who its ultimate beneficial owners (UBOs) were.

Aurora declined, claiming it had shareholders who “were not agreeable to divulging” that information. It was even prepared to walk away from the transaction should Shinhan insist on the disclosure, according to Lee’s court statement.

As a compromise, the bank asked Aurora to appoint a nominee director in Singapore. Nominee directors do not get involved in a company’s operations; they simply help the nominator meet legal requirements in the country.

Lee, who helped connect Shinhan with Aurora, had suggested Yap for the role, and the latter took it up.

Aurora’s subsidiary, Oasis, was also peculiar.

When Shinhan found out that Oasis did not hold WeWork shares, it made another discovery: An unrelated entity also named Oasis Buono Limited did own shares in the co-working giant.

WeWork had issued those shares on May 6, 2016. But Aurora’s Oasis did not even exist on that date as it was only incorporated three months later in August, according to a certificate shared with Shinhan during due diligence.

The bank alleges that the identities of people working for Aurora were also questionable, although Tech in Asia did not find any evidence to back up the suspicion.

Shinhan’s documents claim that several sham representatives instructed Yap in his duties as Aurora’s nominee director. This included opening and operating bank accounts as well as incorporating companies in Singapore.

It’s unclear whether Lee, Yap, or anyone else involved in this transaction ever had a face-to-face meeting with these Aurora intermediaries.

Lee denied the existence of phony identities, saying in a court document that “to the best of his knowledge,” they are real people.

“Most business was done through an informal network of intermediaries, variously referred to as brokers, agents, introducers, consultants or advisors, situated all over the world,” Lee stated. “New introductions are made over the phone on a frequent basis.”

Shinhan maintains that there are no records of Aurora representatives Aaron Wibowo, Gao Wanshou, and Anil Murthy in the public domain. A Tech in Asia online search also did not return relevant results.

These findings ultimately led Shinhan to launch the civil lawsuit.

Just a nominee director?

Another key player in the litigation is Yap. A startup founder and investor, he began his career around 2013 as a business journalist in Singapore, writing for The Business Times and Tech in Asia as well as DealStreetAsia. It was around this time that he got to know Lee.

Yap was Aurora’s nominee director for less than a year, having resigned in September 2019.

In May 2021, before the bank triggered its lawsuit, Yap received notice that a Shinhan representative called Jacky Chan had filed a Singapore police report against Aurora.

In response, Yap gave a statement to the police stating that he “was not involved in the day-to-day management of Aurora,” nor did he “participate in the management and control of the entity or its investment strategy.”

Yap also disclosed Aurora’s UBO: Labave Limited. He described Labave as a private investment and asset management company serving ultra-high-net-worth investors and their families, with over US$350 million in assets.

In line with this, Aurora’s Germany-based management team focuses on commercial real estate in southern and central Europe.

Yap claimed to have been told by Aurora that an employee named Tang Jun was replaced after an internal investigation. This, in turn, allegedly led Tang to admit that he had colluded with Chan to fix the WeWork transaction’s purchase price.

But given Aurora’s opacity, Yap still became a central part of the lawsuit. Besides him, Elumi and Crystal Cove – two of the companies he incorporated under instructions from Aurora – were named as defendants.

Yap maintained his innocence. “I have had no involvement at all in the affairs of Aurora for almost two years,” he wrote in his police statement. “Even at the material time that I was involved, my role was non-executive and purely administrative.”

Despite that, he was slapped with a Mareva injunction, which froze his assets globally and remains in effect.

The Singapore judge who granted the injunction said he is “unable to accept” Yap’s “self-serving declaration” that he had “no knowledge about the fraudulent transactions.”

“At the very least, a credible explanation supported by evidence is required” to support his claim, “but Yap had not produced any,” the judge added.

When asked by Tech in Asia whether investigations are ongoing, the Singapore police declined to comment.

Crypto and high-stakes poker

Aurora claims that Tang is a rogue employee who misappropriated US$3 million from the transaction, court records show.

However, Shinhan believes that Tang is not a real person since it did not uncover this individual while it was tracing Fundnel’s bank transfers.

Instead, the investment bank says it found that more roads led to Lee than previously thought.

Out of all the parties in the second escrow agreement that Shinhan did not know about, Lee had received the biggest sum at US$1.8 million. This was close to 13% of the money that the Korean bank transferred over.

Lee said in his statement that the amount represented his introducer fees, as per an agreement.

Ultimately, Lee maintained that his role in the transaction was solely as an introducer, and that he only knew about the fake WeWork shares after being informed by Chan in 2020.

In his statement, Lee wrote that brokers like himself do not verify or perform due diligence because this is solely the buyer’s responsibility.

Were enough checks done?

Even as Shinhan portrays itself as a victim of a complex scam, the chain of events do raise questions about how it conducts due diligence.

When the Korean bank was evaluating the deal, it had received a share certificate apparently confirming Oasis’ ownership of WeWork’s series C shares, among other documents.

But in Lee’s defense statement, he wrote that Shinhan could – and ought to – have directly reached out to WeWork to confirm ownership “as part of its due diligence, rather than in 2020 when the transaction had already been concluded.”

Regardless, Shinhan’s litigation did yield some fruit. In October 2022, Yap and Labave, Aurora’s UOB, agreed to return US$11.7 million of the owed amounts in installments.

But this arrangement was short-lived: Only one payment worth US$625,000 was made, according to court documents. In July 2023, Shinhan was considering whether to seek damages against Aurora, which has not appeared in court proceedings.

Separately, Shinhan was said to have reached a settlement with Alta Group.

Meanwhile, the bank is continuing its pursuit of Lee, Daniel Hong, and D&R International Capital Management. Hong had linked Shinhan with Lee while Hong Kong-based D&R was also billed as an introducer.

Shinhan claimed in its statements that Lee had been the person instructing Yap and Aurora to make false or fraudulent claims.

“Benjamin Lee knew that Aurora and/or Oasis did not own the WeWork shares and that the representations were false,” the bank said.

Lee responded by saying that Shinhan, together with Yap and the two Singapore entities that the ex-journalist helped incorporate, have not only “astonishingly changed their case,” but they are also seeking “to scapegoat” him.

A trial is set tentatively for 2025.

Post Comment